GMO VenturePartners | Silicon Valley Lab

by Ryu & Sho

Two excessively heavy days of YCDemoDay

The appetites of investors throughout the world will not stop. They are becoming more vigorous and more powerful.

This growing appetite is creating many unicorns in short periods of time, and the market values of those unicorns are increasing tremendously.

And in order to sate the appetites of investors, there is growing demand for a device to mass-produce good entrepreneurs.

For those reasons, the need for mechanism of mass-production of good entrepreneurs is growing.

And the impression that I have is that situations where entrepreneurs are at an advantage are further accelerating.

That is a description of the social backdrop that I perceived after participating in the YC Demo Day for two days.

Y Combinator.

Hardly known to the general public, this odd name “Y Combinator (YC)” is known thoroughly throughout the worlds of startups and finance.

Competition has grown fierce, and while there is a sense that it isn’t as much of an outstanding presence as it had been in the past, it no doubt reigns at the top of the incubators and upper streams of Silicon Valley.

Since its establishment in 2005, over 800 companies have been incubated. People from companies such as Airbnb, Dropbox, Stripe, Docker and Instacart are among the graduates, each of which boasts unbelievably high standards of excellence.

These companies are said to have raised 360 billion yen after their graduations. While this may not apply to all graduates, top VCs such as Andreessen Horowitz (A16Z) rush to invest in promising graduates. Competition among VCs is extremely tough.

Only those of the partner class of VCs who have proven track records are invited to Demo Day, which may also be called the graduation ceremony for the three-month course. It is the origin of club deals and a very exclusive community.

(*the latest infographics as unveiled by YC)

An epitome of Silicon Valley may be seen here.

While there are similar services and entrepreneurs throughout the world, despite the same levels of excellence as entrepreneurs and with similar products, whether we’re talking about Silicon Valley or YC, the chances of success and the upsides will rise dramatically by being in this location.

Why is that?

Even for first-rate VCs, it is not easy to select “projects that are worth considering” from the number of projects that are increasing at an explosive rate. That is the reason why projects which have gone through certain filtering are given priority. Those filters may be the long-term networking between VCs or entrepreneurs, and the filter of being a graduate of YC is said to be considerably effective.

And what happens when a first-rate VC decides to invest? In the case of “A16Z backed”, for example, the perception of other VCs will change dramatically, that the business has to be promising (a Unicorn: a company whose market value is worth 100 billion yen), and it will become easy to hire top class human resources at Google, Facebook, and Apple who are looking for their next promising career change.

What is the mechanism of creating these (though it might sound like an exaggerated expression) unicorns?

I was able to experience it from the inside on this occasion, and the voices of the participants are like the following:

“The standards have become extremely high. There are so many subjects for investment to choose from that I think it’ll be tough to make a choice.”

That is what a student from the previous batch said. They examine all the pitches on the previous day, and the materials should be reliable in the sense of comparison. This person had been extremely excited.

“The investors are evaluated rigorously. They are assessed by the entrepreneurs, and they become rapidly replaced.”

Based on the actions of investors, we have a “Handshake Deal Protocol”* that is based on the deep understanding of the entrepreneurs. I can’t go into detail here but a formidable method exists for shutting out investors with bad behavior from the community.

“The fields have become diverse.”

That’s what a private investor who was formerly with Google said. This person takes part on each occasion, and he remarked that the ratio of the areas in which he invests is decreasing yearly.

“In order to boost the standards, several companies that have already started services are brought on board, as there are limits in creating a service in three months. But everyone says there’s no one who can tell which will become the next unicorn. “Product Hunt” has become famous, but this was just an ordinary individual who didn’t stand out as of the summer,” said another former student from the previous batch. What this means is that no one can tell at that point in time.

I’ll skip the details as there’s a report by TechCrunch, but a simple summary description is like this:

- Companies that are involved in resolving immediate issues; 2. Those that deal with major social problems–these are Internet-related— and we have 3. Healthcare, and 4. Those related to bio, robots, or rockets.

But a key characteristic of this particular occasion had been that companies that already have a certain level of track records had been recruited from around the world. They are generally companies that have a weekly sales growth of 30 to 60 percent, or otherwise they’re startups with a Run Rate (annual gross sales projections) that exceed a million dollars. Anything under that might be cut off.

There are few companies that have no revenue through Freemium. That seems to be the clear change that’s occurred as of this occasion.

Participants are from a diverse range of areas such as India, Hong Kong, and Singapore, and it looks like a world championship.

While I thought I would get a fever after listening to the presentations that had been made by more than a 100 companies and all their interesting products and ideas, several were very interesting for our company as well. We’d like to look forward to their development.

That’s a perspective of those two days. Now, about the Bay Area.

Besides the YC, there are enormous opportunities here and we were busy taking advantage of these. We’re a lab.

The market: the Bay Area is a huge market where eight million people live, where the greatest group of innovators live as consumers. Success in this area could lead to nationwide expansions, and at the same time it’s also possible to optimize to match the various markets around the world.

Amazon lockers set up casually at a 7-Eleven. I was surprised and became a bit annoyed.

A battery charging app for at an IoT that we invest in. Next year, it’ll probably be possible to charge smart phones at all cafés throughout the Bay Area.

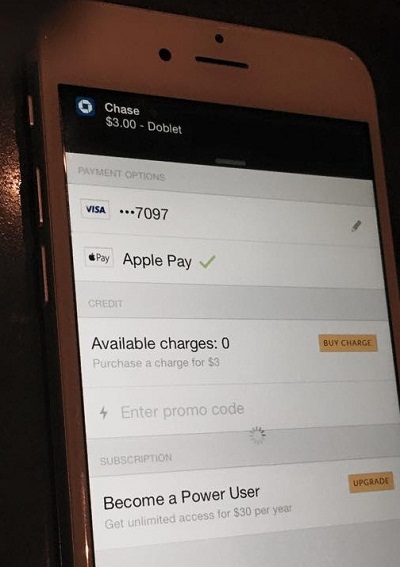

This is Apple Pay, which can be used at supermarkets. It’s available as an app as an ordinary method of payment. It’s now become an everyday device. Here, a formidable future has become a reality of life.

This market has a full lineup of players: Entrepreneurs who have a wealth of personal networks, experience, and talent; executives; and candidate prospects for members.

Branch offices of the world: The branch offices of major companies necessary for partnerships come here from throughout the world.

Investors: They’re here from throughout the world, of course.

Pieces of the puzzle: There’s an assortment of services and their suppliers for resolving various issues that are required for global growth.

I can’t help mentioning a term that’s been used too often: all the necessary components for creating champions of the world are available here. This is a lab of the world.

The Japanese who compete here and the entities in which our company invests

Okay then, we should go right ahead and fully leverage Silicon Valley.

Indeed, Silicon Valley is needed by Japan, Asia, and by Singapore. But in addition to that, this place should be used more for our own global expansion.

GMO VenturePartners invests in a total of six companies like Mercari and Kaizen, initially those whose key market had been Japan.

Those of them who are able to leverage this “lab of the world” are expected to take major leaps to expand in the world.

Mercari

While I regret that I’m unable to write about the methods in the U.S. for developing services, the marketing procedures, or how KPIs differ from those in Japan, we were able to verify an important factor that may be described as “the three major points for a product from Japan to compete in the US.” People who practice in real life are, naturally, different.

Kaizen platform

Although President Sudo had been away, I paid a visit to Kaizen’s San Francisco office. Starting from scratch, it has already grown to this size. It is steadily developing a sales structure that will cover the entire United States.

WalkSource

Six months after the previous batch of YC graduations.

While the team is small in size, it gives an impression of fast growth that is apparent from its high standards of engineering skills and steady achievement of corporate sales. They initiate comprehensive sales efforts to their target hotels and have captured steady demand for big contracts in the “Bay Area, the leading market of the world”—though they aren’t Japanese…

A certain company

This is a person who’s taken a steady first step in this traditional area for joint creations. I’m afraid I can’t give away the company name. Look forward to his work.

So, where are the unicorns?

We’re not an innovator or a VC in the true sense, and we aren’t a typical CVC, either. If I must give you a description, it’s that we are all of them. We will not be fitted into any specific type of framework that someone might have established. In order to discover issues and to create value, we will continue to develop flexible activities in this area as well.

Please continue to look forward to what GMO VenturePartners does.